Reading time: 7 minutes

With the prophets of doom foretelling that we’ll see massive inflation in 2021 and the crash of cryptocurrency (though it may have risen and crashed again five times by the time you read this), looking at the financial bubbles of the past has become popular again. People are talking about Tulipmania, the 2008 recession and even how the imaginary land of Poyais was sold off. In this piece, though, we’ll talk about some burst bubbles you don’t hear about as often.

By Fergus O’Sullivan

Bubbles are periods in which certain assets (often company stocks or real estate, but not limited to those) gain massively in price over a short period; they’re often followed by a contraction, when the bubble bursts. During these contractions, the price of the asset drops rapidly, often because the high appreciation was unsustainable.

They’re a scourge of economics and are as old as the advent of modern capitalism. It’s a story told many times, and in many places; the only things that change are the assets. In 17th century Holland it was tulips, in 21st century America it was real estate (or, more specifically, the bonds that secured them); in both cases, the economy as a whole tanked.

However, these bubbles happen more often than we’d like and, like many things in history, not all of them get remembered. Let’s take a look at five you rarely hear about; also check out our article about the links between global finance and slavery for a similar article.

The Panic of 1819

We’ll start off with the earliest of our five entries, the Panic of 1819, which predominantly affected the United States and was the worst crisis the country had seen, at least until 1929 rolled around. The downturn lasted for about two years, and led to a massive backlash against free trade and a rise of support for tariffs in the U.S.

As with most entries on this list, there’s not a clear-cut answer to what caused the crisis, but in the years leading up to it there had been a huge boom in the price of public lands, which led to a huge increase of loans being given out. When American industry hit a downturn, mostly because the French and British economies picked up after the conclusion of the Napoleonic wars in 1815, people couldn’t pay back their loans and a series of defaults started.

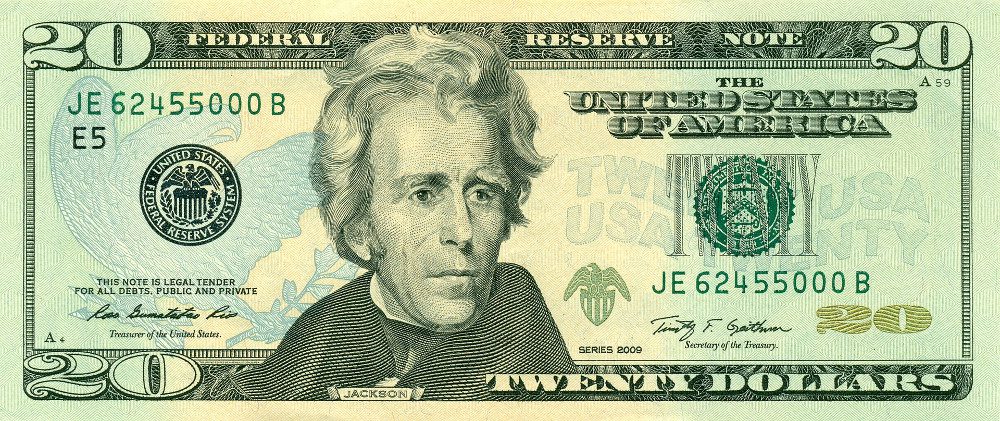

Thousands were wiped out, and the seething resentment among many Americans against the bankers they felt were to blame led to a mass movement. However, little changed until the election of Andrew Jackson in 1828, who instituted a number of laws meant to curb the power of banks, rules that lasted decades.

Railway Mania

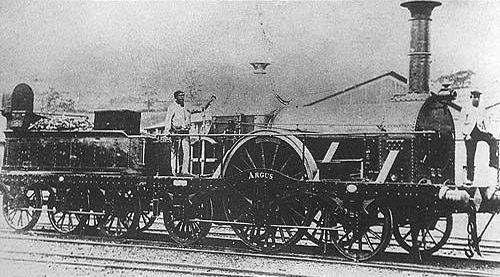

Our second entry is a little more well known than the others, but is interesting because it shows how a new technology — that few people understand — can lead to a massive bubble. In this case, it was the relatively new railway that promised lots, but ended up offering little beyond bankruptcy.

In the 1840s, Britain was building railways wherever there was space, and as a result the price of railway companies’ stock went through the roof, which in turn led to more companies being founded, not all of them legitimate, which further inflated stock prices. As all bubbles, it ended up being unsustainable and the price of stocks eventually plummeted overnight, leaving investors penniless.

The aftermath of the aptly named Railway Mania was thousands of miles of planned track remaining unbuilt, as well as many lines nobody had any real use for lying unused. Though new technology can be a good thing, it seems you should have at least some idea of what it can do before sinking all your money into it.

The Florida Real Estate Bubble

It seems like there’s always something going on with Florida’s real estate prices, especially in the south of the state. It was the site of a huge bubble in the 1980s and also one of the spark points in 2008, but their granddaddy was the real estate boom of the 1920s, which saw huge amounts of money flowing into the Sunshine state.

Starting in 1920 and ending in 1925 or 1926, depending on who you ask, many cities were built practically overnight, among them ones that have become household names, like Coral Gables and Miami Springs, were built. It’s also the time in which parts of the Everglades were opened up for settlement.

The boom was fuelled by the image of Miami as a tropical paradise and holiday destination, with a flood of investors, their pockets full thanks to the overall upturn of the American economy, descending on the state. Like the other entries in this list, this ended up spiking the price of local land through the roof until nobody could afford to buy any of it anymore, leading to shells of half completed buildings along the Atlantic coast.

The Souk al-Manakh Bubble

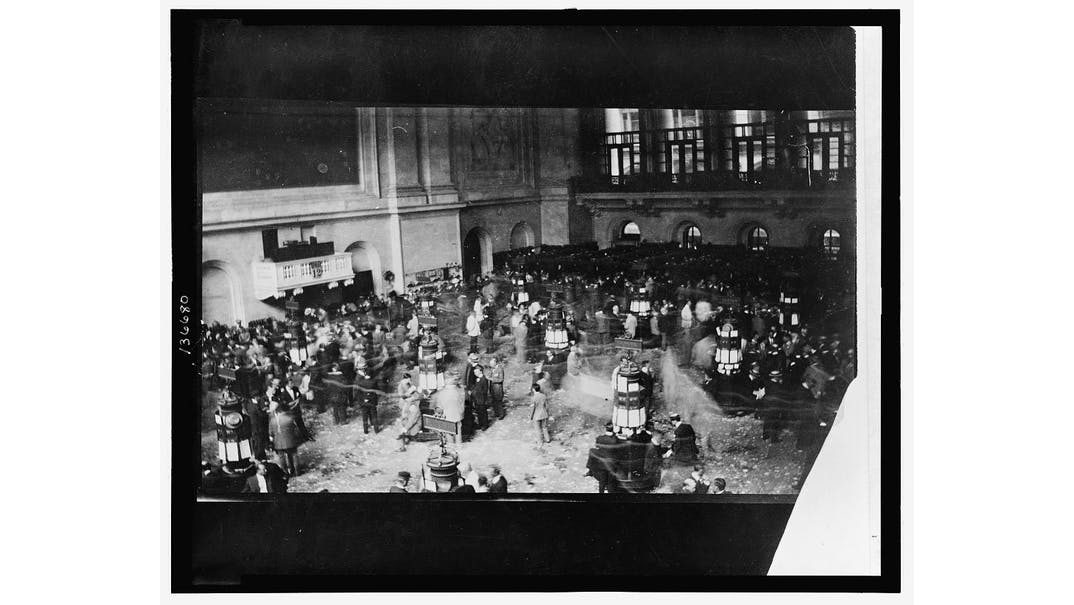

Our fourth entry is an interesting one, in that it involves a tiny country that ended up making a major impact, but in the worst possible way. In the early 80s, Kuwait had exploded into an economic powerhouse, mostly thanks to the massive reserves of oil beneath its topsoil. However, it wasn’t just black gold that fuelled the Kuwaiti economy, they also had thriving stock markets.

That plural is correct, too: one was official and regulated and thus a little staid, nothing like the frenzy of Wall Street. The second one, however, would have made the blood pump harder through any bucket shop proprietor. The Souk al-Manakh traded in an air-conditioned garage over the old camel market and was, you’ll be unsurprised to learn, entirely unregulated.

This excellent article goes into the details, but in short, having a stock market without any rules turns out to be a horrible idea. The Souk al-Manakh was home to rampant speculation in stocks and it eventually collapsed under the weight of its own corruption, taking the Kuwaiti economy, including almost all of the country’s banks, with it. The people ended up picking up the check, to the tune of US$240,000 per inhabitant of the nation; a big bill indeed.

Silver Thursday

We’ll finish up this list with an event that’s unique because we can put a name to the people that blew up the bubble and then burst it, the brothers Hunt. The threesome, scions of an oil baron, decided that they wanted to corner the market in silver and went after their prize with wild abandon, eventually ending up with one-third of the world’s private supply — that held by governments is in a different pool, so to speak.

As a result, the price of silver grew sevenfold in just one year — good news for the Hunt brothers — until they were forced to pay out the futures contracts they had taken out on the precious metal — less good news. When they couldn’t pay on the Thursday the affair is named after, the market as a whole was looking at a loss of $1.7 billion, leading, unsurprisingly, to a panic.

In the end, a consortium of banks rode to the brothers’ rescue and gave them a huge loan to help them pay their debt. Despite nearly bringing the world to its knees, the brothers walked away with nothing more than a lifetime ban from the stock market and a $134 million fine, large enough to force them to declare bankruptcy.

Articles you may also like

How the shadow of slavery still hangs over global finance

When the infamous Zong trial began in 1783, it laid bare the toxic relationship between finance and slavery. It was an unusual and distressing insurance claim – concerning a massacre of 133 captives, thrown overboard the Zong slave ship. By Philip Roscoe, University of St Andrews. The slave trade pioneered a new kind of finance, secured on […]

Trackbacks/Pingbacks