A CONTINENT’S CURRENCY: 20 YEARS OF THE EURO

Reading time: 6 minutes

The central unit of money for much of Europe, the EURO first entered circulation on January 1, 2002.

Every nation has its own unique symbols representative of a distinct culture and people; from national anthems to flags flown with pride, these cultural emblems can indeed be an emotional declaration of nationalistic pride. A country’s currency is also a unique symbol, a “Made in…” concretisation of the nation’s economic prosperity and in many cases independence from colonial rule.

By Michael Vecchio

But what if this monetary uniqueness was replaced for a common currency, not representative of any one country but of many? Would it cause the erosion of national identity, or would the simplification of trade, commerce and exchange put any ideas of a melting pot at ease? These are indeed the questions that arose with the adoption of the EURO, which officially entered into circulation on January 1, 2002.

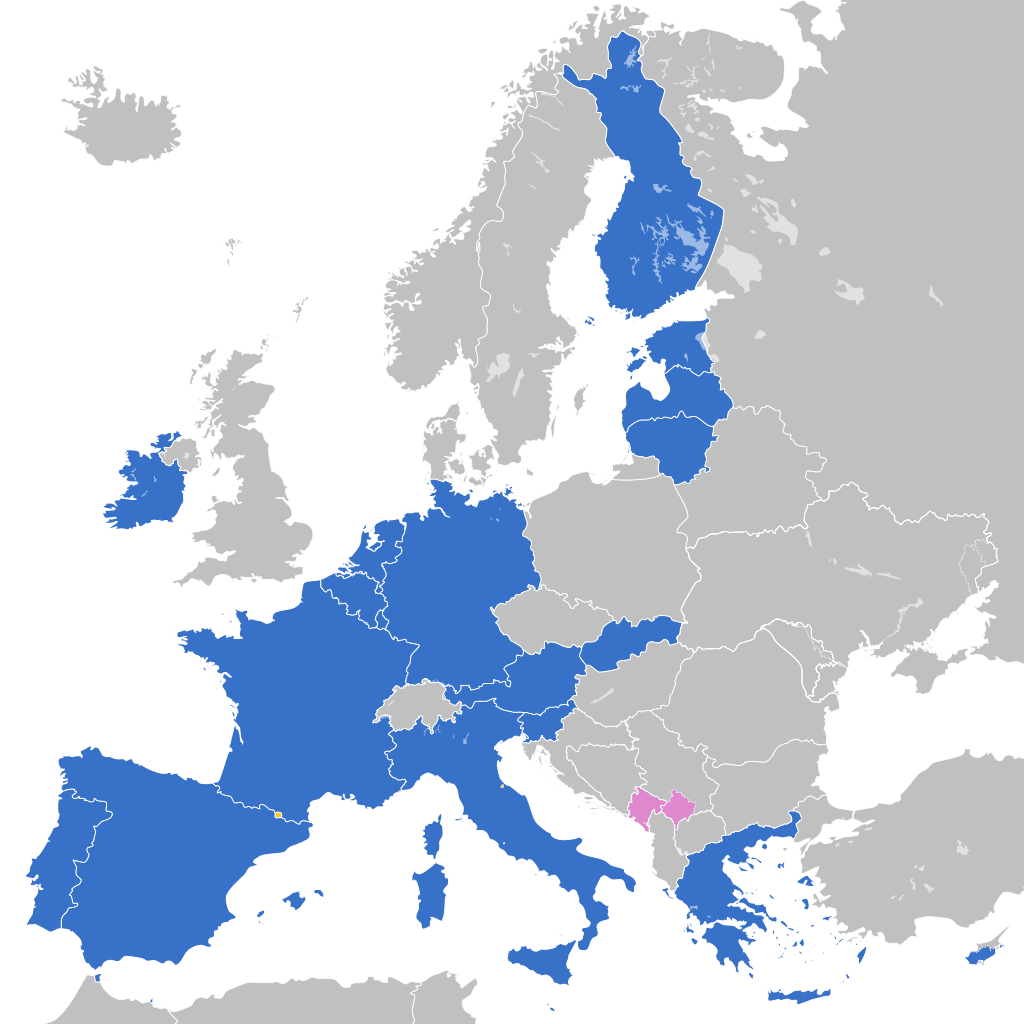

In the 20 years since its introduction, substantial praise and criticism have been made against the Eurozone which is the monetary union of European nations who adopted the currency. It is obvious that Europe and the 19 member states who have assumed the currency have been profoundly changed. Not just by this common cash, but by their presence in the continuing political experiment known as the European Union.

Indeed, as an institution the European Union (EU) has been one in constant evolution since its unofficial formation in the 1950s; seeking to build a lasting European peace and cooperation after the Second World War, the EU has gone from a mere alliance of nations to a formidable political and economic entity. But while the idea of unity amongst the nations of Europe was warmly welcomed, a shared national currency had its detractors from the outset, along with a slew of questions. Who would administer the currency? What would happen to the existing currencies of Europe? And would replacing these currencies equate to an erasure of national history and pride?

READ MORE: THE HISTORY OF THE EU

With the official founding of the EU upon the signing of the 1992 Maastricht Treaty, discussions concerning a new currency found a new sense of urgency. Balancing the need for easier economic co-operation, while maintaining national and cultural individuality, the EU governance wanted to create a currency that could represent each unique nation while also symbolising Europe as a whole. Indeed any astute observer of EURO banknotes and coins will notice different images with ties to the history and culture of the various member states.

But being a member of the EU did not automatically mean the nation would adopt the new currency; under provisions of the Maastricht Treaty, member states had the ability to opt into the proposed single Eurozone currency, with the understanding that if the decision was made to join, it could not easily be reversed.

Amongst the most prominent member states to voice objection to the Eurozone and the new EURO currency was the United Kingdom, who retained the Pound Sterling. Of course the UK would controversially go a step further and leave the EU altogether after the 2016 Brexit referendum.

READ MORE: WHAT YOU NEED TO KNOW ABOUT THE UK LEAVING THE EU

On the whole however most of the members of the EU signed on to the phasing out of their national currencies, while the city of Frankfurt was chosen as the site for the newly created European Central Bank (ECB) in 1998. Although the national banks of the member states still continue to operate, the ECB makes the most important decisions regarding interest rates and exchange rates. It retains the sole power to issue EURO banknotes and coins, which are then distributed to the various national banks.

are highlighted in blue. Wikimedia.

And so it was that on January 1, 2002, Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Portugal, and Spain officially left behind their national currencies, and welcomed the EURO. Past currencies like the Deutsche Mark, the Italian Lira, the French Franc, and Spanish Peseta, now took on a historical and nostalgic value, as the new unified European market was entrenched. Since its inception in 2002, the Eurozone has grown in membership with Slovenia joining in 2007, Slovakia in 2009, Estonia in 2011 and Lithuania in 2015; Croatia is the next planned economy to join with a tentative date of 2023.

Apart from the United Kingdom, other prominent member states who continue to use their own national currencies include Poland, Sweden, Norway, and the Czech Republic. But besides the perceived loss of a uniquely national symbol, the introduction of the EURO has brought a substantial benefit to the continent.

With a single currency, prices have been kept relatively stable and the economies of the member states have been largely protected from exchange rate volatility. The EURO has eliminated the need for currency exchange, while the cost of transferring money has been lowered; this has all made travelling and moving to another country much simpler. Borrowing money for home buyers, businesses, and even governments has too been simplified with a common currency.

READ MORE: THE EUROZONE DEBT CRISIS

According to data released from the EU, the EURO is the second most important currency in the international monetary system, with around 40% of it used for global cross-border payments. In attempts to create more green economies, the EURO too is prominent, with more than half of the world’s green bonds denominated in the EURO.

Yet like any world economy, the EURO has seen its down turns, which included the European Debt Crisis and of course the ongoing recovery from the COVID-19 pandemic. But the switch to a common monetary unit has still brought with it a renewed prosperity and is undoubtedly a key component of European unity, as constantly promoted by the EU.

Through it all the 20th anniversary of the EURO is indeed a worthy commemoration of a largely successful economic and cultural experiment; it transformed the European continent and its unified place on the world stage all while creating the perfect example of economic cooperation and partnership.

Podcasts on this topic

Articles you may also like

Menzies’ call on Vietnam changed Australia’s course

Reading time: 4 minutes

In 1965, Australia was involved in two crises in Southeast Asia, one in Vietnam and the other in Indonesia. The connection between the two was vital to Menzies’ decision to increase our involvement in Vietnam. Having already committed a battalion to Malaysia to support resistance to the Konfrontasi policy of Indonesia’s Sukarno government, the logical next step for Menzies was to look to Vietnam. He did this with the support of his Cold War warrior and minister for external affairs, Paul Hasluck. They decided to send an Australian battalion to South Vietnam, partly to ensure continued American interest in the region.

The text of this article was commissioned by History Guild as part of our work to improve historical literacy. If you would like to reproduce it please get in touch via this form.